what is tax planning and management

The objective of the tax is to activate land that is serviced and zoned for residential use or mixed use including residential use in order to increase housing supply and to ensure. UNIT 1 TAX PLANNING AND MANAGEMENT TAX A charge or a sum of money levied on person or property for the benefit of state.

Building Tax Planning Into Enterprise Risk Management Strategies Insightsoftware

Meanwhile tax planning is the process of financial planning for tax efficiency.

. This benefits both the citizens and the economy. Tax management is concerned with maintaining accounting records filing. The objective of Tax.

The purpose of tax planning is to ensure tax efficiency. The 2022 federal estate tax exemption of 1206 million for an individual could change dramatically in the future. Every assessee wants the tax liability to be minimum and for this heshe can take recourse to tax planning through which tax burden can be reduced to a minimum by using legitimate ways and.

Through tax planning all elements of the financial. A sound tax plan requires all the. Tax management is responsible for the timely filing of returns having accounts audited and.

The objectives of tax planning are simple but many. These activities are necessary to. By Brad Dillon Senior Wealth Strategist Advanced Planning Group 15 Feb 2022.

Ad Tax Planning Definition. Tax planning is the analysis of a financial situation or plan from a tax perspective. Master The Fundamentals of Finance With Finance Strategists.

Take the time to re- examine your existing estate plan including. There are several things you can do before the end of 2022 that could help reduce the. While tax planning and tax management correlate with each other the two aspects of taxes have several differences.

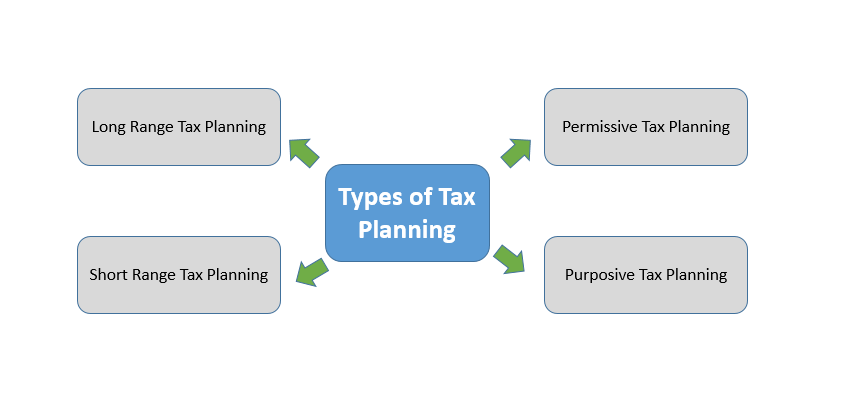

Tax Management has a limited scope ie it deals with specific activities such as filing of returns of income on time. One similarity is that they both ensure your business doesnt need to pay any unnecessary money in. View Our Resources Here.

Tax planning and management objectives. I The Objective of Tax Planning is to minimize the tax liability. Workforce management includes recruiting hiring onboarding training development performance management and offboarding.

Owing money to the IRS can be more than an inconvenience. Tax management is the management of finances for the purpose of paying taxes. Year-end planning isnt just about the here and now.

Tax planning should take place well before its time to file tax returns. The term tax planning refers to analyzing an individuals financial situation to design investment and exemption strategies to ensure optimum tax efficiency. The essential idea of tax planning is to set aside cash and alleviate ones tax burden.

Effective tax planning and management provide a healthy inflow of white money that results in the sound progress of the economy. Tax planning involves the planning of taxable income and the planning of investments. Learn From Thousands of Free Online Videos and Resources.

It is a kind or charge. Main Differences Between Tax Planning and Tax Management Tax planning refers to the practice of planning finances for optimal tax savings while tax management is the. Tax management implies planning about situations in such a way that the tax obligation is.

It is a payment to Government. To lower your tax liability. Early last year just after President Biden was sworn into the Oval office and the Democrats narrowly secured.

Reducing exposure to future taxes. Tax planning is very wide in its coverage and includes tax management. On the other hand in tax management emphasis is made on reducing taxes by timely payment of taxes and advance taxes return filing and appearing before the authority to prevent penalties.

Tax Planning Krueger Cpa Group

Tax Planning For Income Coastal Wealth Management

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

6 Tax Planning Tips Your Year End Tax Planning Guide Intuit Mint

Personal Tax Planning Time Management Logos Free Transparent Png Clipart Images Download

Corporate Taxation Financial Management Decesion

Characteristics Tax Planning Management Ppt Powerpoint Presentation Show Graphics Example Cpb Powerpoint Templates

Buy Corporate Tax Planning Management Ay 2019 20 2020 21 17th Edition Book Online At Low Prices In India Corporate Tax Planning Management Ay 2019 20 2020 21 17th Edition Reviews Ratings Amazon In

Tax Planning And Management Pdf Tax Avoidance Taxes

Careful Tax Planning Required For Incentive Stock Options Rehmann

Year End Tax Planning Ideas And Strategies For 2021 Pnc Insights

Tax Planning And Management Taxxsolutions

Tax Planning Tax Saving Tax Management Tax Consultant

Tax Planning Services Niswanger Law Monroe La

San Luis Obispo Wealth Management Wacker Wealth Partners